The newest said mortgage rates on their website commonly need credit of a lot 720+ and reasonable LTV cost such as for instance 70% restriction. Additionally, max DTI are 43%, and this suits to the Subscribed Financial (QM) rule.

It seem to be good .125% if not .25% greater than what I have seen has just together with other grand loan providers, such Economic off the you otherwise Wells Fargo.

What makes ditech Financial Most other?

- They are a reliable brand i’ve read away from

- Is also originate capital with couple overlays due to solid support

- And they have good correspondent credit area

- Also a broad program

Besides the lowercase identity, he’s got numerous publication properties. For example, he’s a reputable brand name with many different support at the rear of your partner, so that they can originate loans that have couple agency overlays.

It means you can easily utilize a lot more competitive and versatile monetary underwriting advice one almost every other financial institutions and you may mortgage lenders might not be happy to provide.

Nonetheless they supply the Fannie mae MyCommunityMortgage, the FHA’s $a hundred downpayment financing program, offered lender-paid off financial insurance policies, plus Freddie Only program, permitting these to deal with LP (Loan Prospector) findings away from Freddie Mac.

If you happen to taking an excellent correspondent financial, there is the capacity to rate, secure and send personal money through the ditech webpages.

Overall, it appears as though what will place him or her out is the proportions/backing/preferred name. I are not remember your ex and that try sufficient to offer all of them a plus, or at least a foot back to the entranceway.

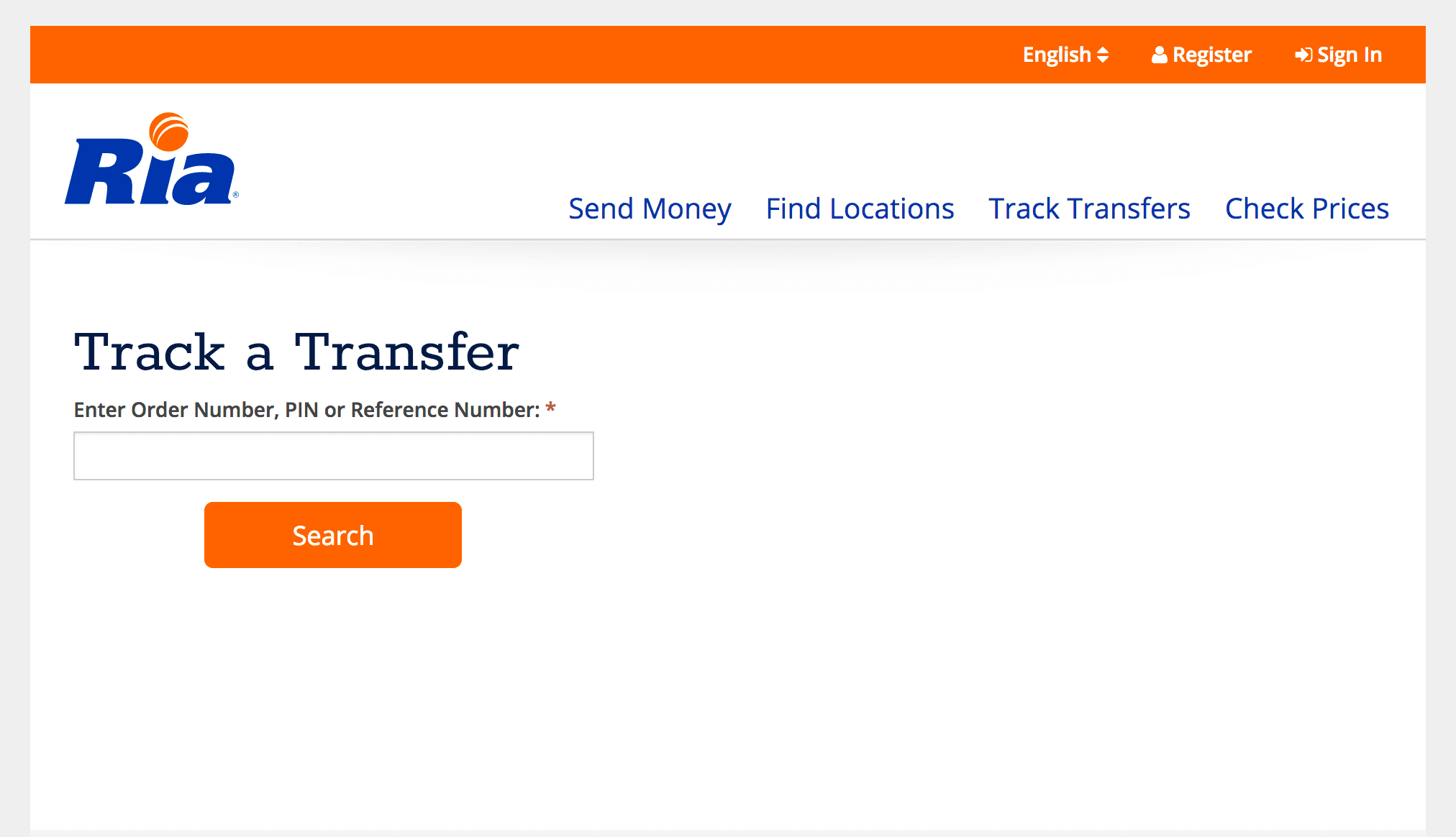

I do want to get a hold of a tad bit more tech from them offered their in this term, not, they’ve produced zero mention of being able to fill for the data on the internet and/if not track the newest position out of financing online. That could be a pleasant pressing, specifically because of the fintech players expanding within this place.

They just look a bit universal not any book has in the event that things, they feels as though an effective throwback to ten years back, in place installment long term loans no credit check Phoenix NY of another eyes.

Ultimately, merely to get this to straight, three significant lenders (and several shorter of these) taken place to the introduce house drama, also Nationwide, IndyMac, and you will GMAC.

Today, obtained morphed on Financial of your own united states of america/PennyMac, OneWest Bank, and you can ditech, correspondingly. Its interesting to see what they getting this time given that our home mortgage profession continues to recreate in itself.

Update: Ditech also provides mortgage loans in just 3% out-of via the this new Fannie mae 97 system. As well, it has just found a wholesale financing route and are now accepting programs regarding loan providers.

Ditech Carry out-getting on the market

- The business released into the later

- It actually was exploring strategic solutions

Contained in this brief age since the group relaunched, ditech says it’s now examining proper selection towards the let off Houlihan Lokey because their monetary coach.

Owing to rising home loan rates, of several shops provides commonly signed otherwise offered-out additional opposition. And exactly how everything is heading, capital origination volume sometimes beat then.

So it is not knowing whether your business is just seeking to toss toward fabric at the beginning of progress out of things get any difficult, or if there clearly was one more reason at rear of brand new effort.